Even for a business with a single location, payroll can be complex. Mistakes can damage your company’s business operations, reputation, and financial standing.

The risks increase when you expand across state lines or international boundaries. If your payroll operation is not prepared to manage your expansion, it becomes a chokepoint that limits your company’s growth.

A smooth, error-free payroll operation is the foundation of your organization’s relationship with its employees. If the process operates well, it is invisible. If it doesn’t, it can affect productivity, turnover, and your recruiting brand.

The foundation for a smooth, error-free payroll operation is discipline and accountability, at every level and every step of the process.

Instilling accountability begins with transparency. Building trust where people feel comfortable holding each other accountable requires open communications.

Over the past five decades, we have seen everything from efficient, effective operations to dismal disasters. We want to share some of the practices that make the stellar operators stand out.

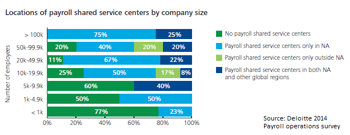

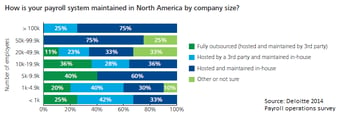

Outsourcing routine HR and Payroll functions can reduce costs and free management and professional staff for more strategic activities. Outsourcing can include strategies from consolidating functions in a shared services center to offloading all HR and Payroll activities, but most large global companies maintain 24-hour service centers in North America.[1]

Software-as-a-Service outsources the technology, but not the business processes. A vendor or service provider hosts software applications on a subscription basis. This model provides predictable costs and frequent software updates. It frees up IT resources so they can focus on more strategic activities.

Business process outsourcing entails contracting with a third-party service provider who provides both the software and services. This arrangement offloads the administrative burden to specialists so you can focus on your core business. It can also give you access to specialized knowledge, which can be essential in global operations where you are dealing with dozens or hundreds of regulatory and taxation authorities.

Developing your outsourcing strategy requires planning and careful timing. You will save costs, but the outsourcing process itself incurs substantial expense. Work with your CFO to develop your business case. Consider whether you can manage the change without disrupting the current operation and whether you have experienced resources on your staff. Managing vendor relationships can be complicated.[2]

Your payroll activity may seem automatic and times. Keeping it that way requires discipline and accountability. Make sure your payroll service protects your company and its people.

References:

1. “Payroll Operations Survey summary of results.” Deloitte. January 7, 2015.

2. “Outsourcing the HR Function.” SHRM.org. November 6, 2015.

Payroll can have a significant impact on how successful a merger or acquisition will be, but it is only one part of the human capital factor. It will be up to the CHRO, Payroll Manager, and CIO together to keep the transition team on track. Your people are the most important part of the organizational change, and what you do will influence how much they help make it successful.

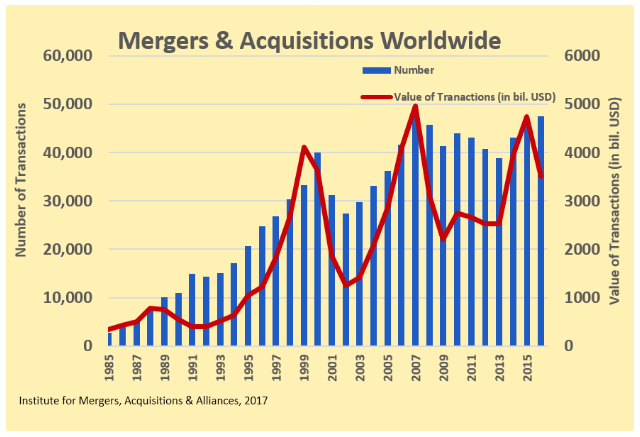

Chances are if you have not been affected by a merger or organization, you soon will be. Buying or merging companies is proving to be a mainstay in organizational growth.

Mergers, acquisitions, and restructurings can take many forms. It would be impossible for us to lay down an exact blueprint, but we can provide a framework. Good planning begins with aligning your project to your organizational strategy.

The place to start is with how you will structure the new entities. Is your company acquiring another that will operate independently, or are you merging two organizations into one? Is it something in between? Will it begin with a simple co-branding and become one company over several years?

Evaluate the workforce needs of the new structure. Will there be redundancies or relocations? Do you have a well-managed outplacement program in place to protect your company brand and control your costs? Will you need to merge competency models and L&D?

Cultural assimilation will make or break an organization. Ensure that you have the resources and a plan in place. Begin change management before rumors start, and don’t stop at go-live. Continue until the organization has completely assimilated.

Since people are the greatest expense and value driver of your organization, your HCM technology, including payroll, should be a top priority. Your CIO will scramble to deal with the changes, and the better prepared you are, the better your CIO will support you.

Will you need to upgrade current HCM and payroll platforms? Will you need to localize your applications for the first time? Can you save costs by outsourcing? If you have different systems, will one survive or both?

If your organization doesn’t have a formal data governance team and a master data management plan, we recommend you make it a part of your project execution. If you are having data difficulties now, a lack of governance in a merger will only compound the problems. Even if your data governance efforts only include your part of the implementation, it will be a start. Your success will influence and guide the rest of the organization.

Your plan to execute the changes in payroll should be in step with the organizational change plan. You need to move quickly but cannot afford to overlook due diligence.

At a compliance symposium about ten years ago, the keynote speaker began with a zinger:

“In a small business, a Payroll Manager can usually do fairly well at HR administration. They are meticulous record-keepers and know how to stay in compliance. If you ask your HR Manager to handle payroll, you are in trouble.”

I laughed along with everyone else, remembering back to the time when a payroll implementation failed. My first indications were people standing outside my office asking about their paychecks. When we learned the fix would take two months or more, the company issued chequebooks to HR managers so we could estimate pay and write cheques. We worked closely with Angela, the Payroll Manager, and kept her sane while she worked with IT to straighten out the mess.

That exciting experience that broadened my horizons. I made a lot of new friends at the local Wage and Hour Division office.

In honor of Angela’s hard work recalculating my “estimates,” I want to pass on a few tips learned over the past fifteen years in HCM technology.

Because Payroll is a repetitive process, machines can do the work better than people if you manage the tools well. Automating Payroll can cut costs by as much as 80%./Data_Sheets%20Resource%20Home%20page%20images/D17_HCM_Payroll_resource.png?width=264&name=D17_HCM_Payroll_resource.png)

Automate your payroll tax forms and integrate them into your onboarding application. Set up alerts to notify you if a new employee fails to complete the documents, and audit your records frequently.

Moving to the cloud will cut costs, ease integration, and make it easier to update your software. Almost all cloud vendors update their platforms automatically when laws and regulations change.

Integrate your Payroll process with Finance and HR systems. Since nearly all the employee transactions affecting pay originate in HR or self-service operations, you will eliminate duplication and error with a well-designed interface. What you spend in design and integration will repay your costs many times over.

The data your process generates is invaluable to planning. Unify your reporting so you can integrate Payroll into cost analysis and show your business leaders what people cost.

Classify your workers properly. Misclassifying employees as independent contractors can incur substantial penalties. If necessary, get a legal review. Pay contractors through Accounts Payable and let Procurement handle the financial details of the contractor relationship.

Keep managers aware of what constitutes a contractor relationship. If they attempt to exert control over when and how a contractor performs work, they can run into trouble. Most freelancers and contractors choose that lifestyle because they want freedom from control. Managers need to coach and develop their contractors, but micromanaging will sour the relationship, and could create the appearance of an employee/employer relationship.

Your organization needs to stay on top of costs and trends. Fragmented systems will make that exceedingly difficult. Global business platforms like Workday, SAP, and Infor make it possible for you to centrally manage broad policies and procedures across the organization while giving your local managers the control they need.

You can outsource processing to local providers so your local managers can be more responsive to local authorities. We advocate outsourcing payroll processing wherever possible. It’s a great way to cut costs.

Keeping employees informed about their pay will promote trust and understanding. Make the payroll process transparent, and publish information to employees about how the process works.

You will generate much of the information about pay from your Compensation team. Informing people how you determine salaries, how you calculate each pay element, and how you calculate salary changes is more important than the actual numbers.

Keep employees well informed of how you determine leave balances, eligibility, and paid time off. Give them the details of year-end adjustments and how you calculate them.

Create a simple diagram of the payroll process and make it available to employees wherever they are.

How you manage direct deposit depends on your culture, but your aim should be 100% participation. A printed check costs many times more than a bank transfer and is much harder to manage if there is an error.

If employees resist, you can require it for new hires only. When your people see their new teammates receiving pay earlier than they do, they will change their minds.

The cause of the troubles I described was inadequate testing. We recommend end-to-end parallel testing for as long as it takes to be sure there will be no issues after go-live. Test and retest every process from the initial transaction to the final file transmission.

Your automated Payroll platform should allow you to configure alerts and notifications to tell you of processing errors or if transactions exceed specified limits or violate rules. We recommend you also conduct frequent regular audits so you can catch problems before they escalate.

If you are outsourcing, bear in mind that some payroll providers strive to be the low-cost solution. Selecting a vendor solely on price may not lead to the best choice. Accuracy, service, and ease of use (including integrations) count for much more.

Consider experience and expertise, but more important, choose a partner who will work with you. The right partner will take the time to understand your business and your needs, and will be sensitive to your constraints.

We have always admired Payroll Managers. People who can hold their breath from the last payroll of one year until the first payroll of the next without passing out deserve a special place in the pantheon.

New cloud payroll solutions that remove much of the stress and risk from year-end payroll closeout. These sleek new platforms from vendors like Workday and SuccessFactors do not eliminate the need for diligence, but they do make updates much easier. Workday provides the means to run test calculations on the fly without the need to set up a separate test instance.

Unlike legacy systems, cloud vendors who have customers on a single code base can automatically apply tax and regulatory updates for all customers. Although customers should test updates as recommended, they do not have to bring their systems down to apply patches.

Each vendor publishes its own year-end checklists for payroll management of the year and the first run of the next, but we want to provide here some general guidelines. We hope they make year-end processing easier for you.

Preparation can go a long way toward making the year-end a good time for enjoying a little time off for relaxation. Our best wishes to you for a stress-free year-end process.

Pixentia is a full-service technology company dedicated to helping clients solve business problems, improve the capability of their people, and achieve better results.