One of the advantages of being a seasoned professional is that we have the memory of how we worked before we had cloud technology. It helps us appreciate what modern technology has done for us. Most millennials cannot conceive manual time sheets, payday trips to the bank, and having an army of people to audit payroll.

ERP Payroll systems of the 1990s streamlined timekeeping and payroll processes, but much of the tedium remained. Software built on relationship databases was clunky and hard to use. We still had a lot of manual data entry, long processing times, and endless poring over page after page of reports to find and correct errors.

Long after talent management moved to the cloud, Finance, Payroll, and IT guarded their legacy platforms. Until recently the suggestion to move payroll to the cloud met with resistance. Most of the pushback came from security concerns and the fear of losing control.

Workday® changed that perception when they launched Finance and HR in the Cloud in 2006 using fast in-memory processing and an object model approach to programming. The object-oriented concept was not new, but applying it to core financial operations was a bold move.

Now that cloud technology has matured enough to prove its security and stability, cloud payroll implementations are growing.Workday® Payroll has 757 customers, of which 510 are live on the platform.Also Workday® has the integrations and software to manage any third party payroll worldwide.

Payroll management services in the Cloud gives us solid advantages over legacy platforms.

Robust dashboards. You can run the processes, view and analyze the results, and make adjustments and corrections before you commit them.

While these improvements make payroll operation and maintenance much easier, implementation still requires the same diligence as legacy platforms. Your implementation partner will lead you through the standardized Workday® implementation steps, but there are actions you need to take in your organization to make sure a successful launch.

We hope these tips help you in having a trouble-free Workday® Payroll launch. If you think of any other points we should discuss, please use the comments section below to share your ideas.

References:

1. Verified by Workday® Sales Team, October 19, 2016.

If you are thinking about implementing Workday® Payroll, you are about to experience payroll as it should be--agile, manageable, transparent and accurate. If you are tired of payroll managing you, get ready to turn it around.

If your Payroll system is working well, it is nearly invisible; if it isn’t right, nothing else matters. We know this from experience in the HR trenches during the days of disconnected systems and manual processing. But rather than share our stories, let us tell you some of what you can look forward to.

Your implementation will follow the prescribed Workday® methodology that has worked for hundreds of organizations, but there are some preparations you can make to make it faster and smoother. Here are some best practices we have gleaned from our experience.

Change Management

Start your change management program the moment you know you will make a change. Too many implementations treat it as an afterthought or fall prey to the illusion that training and change management are the same.

Some consultants say documenting the current processes is a waste of time. We disagree. Being prepared for the configuration discussion will help you move through that phase quickly, and will help you explain the rationale to the people affected. We don’t recommend spending a lot of resources on mapping current processes, but you do need to identify the workflow and pain points. Dust off your old process maps and mark them up.

As you develop your new processes and procedures, document them well. They will serve you well when it is time to make a change.

Break up your initiative into smaller projects where it makes sense to do so, and manage them with the same diligence as the overall project. Some of the activities that will become sub-projects include:

Understand the needs of your benefits providers, retirement plan TPAs, and regulatory agencies. Plan your integrations and include them in your parallel testing.

We hope these recommendations help you prepare for your Workday® Payroll Implementation. If you prepare diligently, you will find your implementation will flow smoothly. If you handle change management well, you will find your entire organization will support your efforts.

One of the weapons in the war for talent is employee incentives that address a particular pain point for a target talent pool. When companies are trying to get an advantage in attracting and retaining talented people, helping with a unique problem related to any work/life balance issue can give an employer an edge.

Sometimes these unique ideas can present a challenge for payroll processing when they reside in different applications. We recently had an occasion to use Workday® Studio to resolve an interesting case.

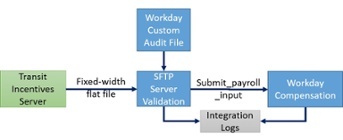

A company provides daily work transit benefit to its employees. The benefit is a complex mix of earnings, pre-tax and post-tax deductions, and free benefits to defray commuting and parking costs. Workday® is the system of record for compensation. The company uses an on-premises server they call Transit Incentives.

We think you may find the solution to be useful in managing your special cases.

The solution is to create a Workday® Studio inbound integration on a weekly schedule to import a file and submit it to Workday® Compensation. We use the Workday® web service Submit_Payroll_Input. Here’s how this five-step process works.

Although the data, audit file, and pay entry business rules may differ, you will find this process should work for any incentive payment on a client server.

We hope you find this information useful. Please join us on our blog to see some of the other solutions we share.

Pixentia is a full-service technology company dedicated to helping clients solve business problems, improve the capability of their people, and achieve better results.